The revised HSR thresholds will apply to all transactions that close on or after the effective date, which is 30 calendar days following publication of the adjusted thresholds in the Federal Register. This year, the adjustments were published on February 2, 2021, so the effective date is March 4, 2021.

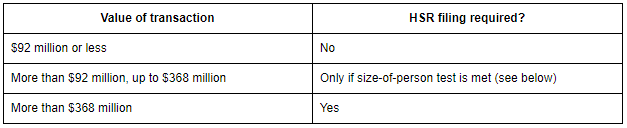

Adjusted threshold for size-of-transaction test

The minimum value of a transaction that could trigger an HSR filing will decrease from $94 million to $92 million.

For any agreement entered into prior to the effective date (March 4, 2021), the new thresholds will apply so long as the transaction is closed on or after the effective date.

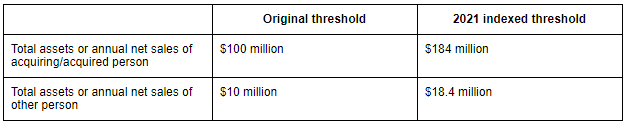

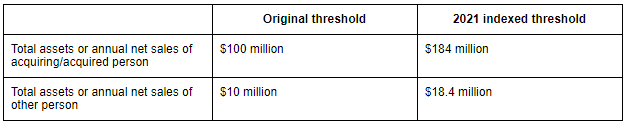

Adjusted threshold for size-of-person test

The following table reflects the new annual thresholds for the size-of-person test, which also decreased from 2020. For transactions valued at more than $92 million and up to $368 million, an HSR filing is only required if the size-of-person test is met.

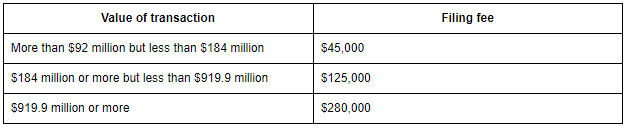

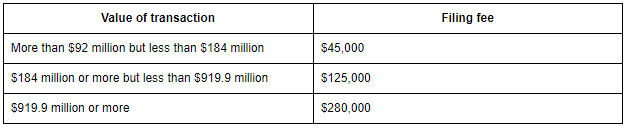

Filing fee thresholds

The new thresholds do not change the HSR filing fee amounts, but the applicable filing fee will be based on the new thresholds as of March 4, 2021. For transactions that are imminent or are currently underway, the applicable filing fee thresholds are those in effect at the time of filing notification.

Civil penalties

On January 11, 2021, the FTC announced that the maximum civil penalty amount for HSR Act violations will increase from $43,280 to $43,792 per day, effective as of the date of publication in the Federal Register (January 13, 2021).

Non-reportable and cleared transactions

Noncompliance with the HSR Act carries serious penalties, but the fact that a transaction does not meet HSR filing thresholds does not mean that such transaction is immune from scrutiny by antitrust enforcers. Also, the fact that a transaction has received HSR clearance to close also does not mean it will avoid the scrutiny of enforcers. The Antitrust Division of the Department of Justice and the FTC have previously filed suits seeking to unwind consummated mergers, including mergers that had received clearance following antitrust review. Enforcers have also challenged transactions well below the threshold for the size-of-transaction test, including those with a purchase price of less than $10 million.

Given the complexities and nuances in this area of the law, it is always wise to consult with experienced antitrust counsel regarding HSR filing obligations and substantive antitrust issues in connection with transactions of all sizes. To learn more about our experience, please contact any of the authors listed below or the Reed Smith lawyer with whom you regularly work.

Client Alert 2021-038