Authors

Pennsylvania’s Bonus Depreciation Decoupling History

Most states disallow federal bonus depreciation, then provide an adjustment to put the taxpayer in the same position it would have been if bonus depreciation did not exist.1

Pennsylvania always intended to decouple from federal bonus depreciation, but, as many taxpayers are aware, it chose a different (and much more complicated) method—by enacting a mathematical formula. That method worked when first introduced in 2002, when federal bonus was 30%.2

But as soon as federal bonus increased to 50%, the statutory formula no longer worked and left taxpayers with less depreciation throughout the property’s useful life than if Pennsylvania had simply decoupled in the same manner as almost every other state.3 Statutorily, this issue was a mere timing difference, but caused a major headache for taxpayers.4

In 2017 after the federal government enacted 100% bonus depreciation, the Pennsylvania Department of Revenue concluded that the existing statutory mathematical formula did not allow taxpayers to take any depreciation on bonus property until the year the property was sold.5 This not only frustrated taxpayers, but was contrary to the legislature’s original intent. Thus, the General Assembly stepped in to fix the mathematical formula, so that, once again, the statute put taxpayers in the same position they would have been if federal bonus did not exist.6

The legislature’s fix worked, but only so long as federal bonus remained unchanged.7 In 2023, when federal bonus decreases from 100% to 80%, the mathematical method under Pennsylvania’s existing statute results in what we’re calling Pennsylvania super-depreciation.

Pennsylvania Super-Depreciation Beginning 2023

Pennsylvania’s new super-depreciation works like this: a taxpayer deducts, in computing its federal taxable income, bonus depreciation (80% of the property for 2023)8 plus non-bonus MACRS9 depreciation on the portion of the adjusted basis remaining after bonus (20% for 2023).10 Pennsylvania requires a taxpayer to add back the bonus, but not the non-bonus MACRS.11 Pennsylvania then gives an additional depreciation deduction equal to the non-bonus MACRS computed on the original basis amount.12 The consequence is that a taxpayer gets both (1) a non-bonus MACRS deduction computed on the 20% adjusted basis left over after 80% bonus plus (2) a non-bonus MACRS deduction on the original basis of the property as a Pennsylvania deduction. Deduction (1) flows from the federal return; deduction (2) is an additional deduction for Pennsylvania purposes. Effectively, this means that a taxpayer is allowed greater depreciation than it would have been allowed if Pennsylvania had simply required taxpayers to depreciate as if bonus didn’t exist.

Ironically, as federal bonus decreases, Pennsylvania super-depreciation increases: in 2023 the method results in 120% greater first-year Pennsylvania depreciation than the method used by most states; that increases each year to reach 180% in 2026.13

This is all just timing because in the aggregate, Pennsylvania’s additional depreciation deductions are limited to the total amount of federal bonus added back in year one.14

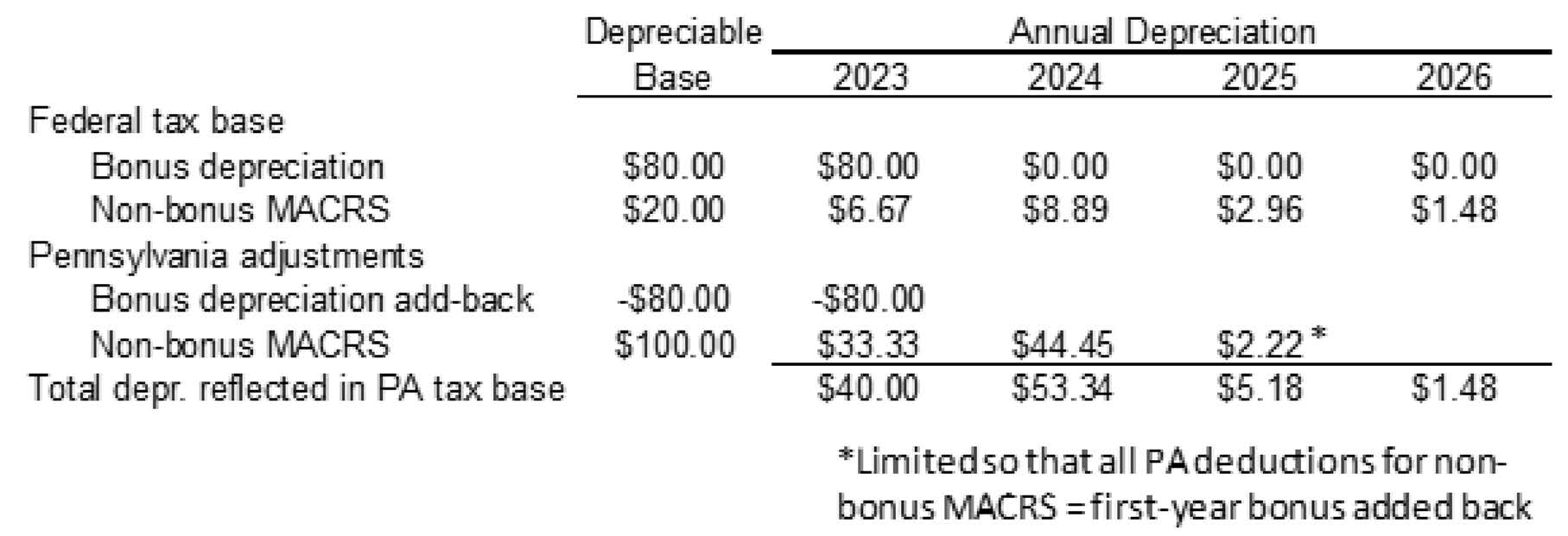

Here is an example if a taxpayer places $100 worth of three-year property into service in 2023 (the example is reflected in the chart below). The taxpayer gets $80 of federal bonus depreciation, plus a federal non-bonus MACRS deduction of $6.67 on the remaining $20 ($6.67 = the remaining $20 x the first-year MACRS rate for three-year property of 33.33%). For Pennsylvania, the taxpayer adds back the bonus ($80), then gets a Pennsylvania depreciation deduction equal to $33.33 ($100 x the first-year MACRS rate of 33.33%). So the taxpayer’s first-year total bonus deducted is $40 ($6.67 federal depreciation not added back + $33.33 of Pennsylvania additional deprecaition). This is 120% more than the depreciation the taxpayer would have gotten had Pennsylvania simply required taxpayers to depreciate if bonus didn’t exist.15

This continues each year of the property’s depreciable life until the full amount of the bonus depreciation added back in year one is fully recovered. In this example, the taxpayer’s 2025 additional Pennsylvania depreciation is limited to $2.22 because its depreciation is capped at the $80 of bonus depreciation it added back in year one ($80 bonus depreciation added back in year one, minus $33.33 of first-year Pennsylvania non-bonus MACRS depreciation, minus $44.45 second-year Pennsylvania non-bonus MACRS depreciation = $2.22).

Example: $100 of three-year property placed in service in 2023

Variations to this example produce interesting results. For example, in 2026 Pennsylvania will effectively conform to federal bonus depreciation for certain types of property.

What’s next?

Pennsylvania super-depreciation may be an unintended consequence of its unique treatment of federal bonus depreciation. Pennsylvania’s General Assembly could amend the statute so that Pennsylvania’s disallowance of bonus depreciation does what was intended when Pennsylvania fist decoupled from federal bonus in 2002, and when it was “fixed” in 2018: change the statute so that a taxpayer is in the same position it would have been if bonus depreciation did not exist. But given Pennsylvania’s history of letting unintended depreciation consequences go unresolved for nearly a decade, a legislative fix may not happen. It’s also possible that, even absent legislative action, the Department of Revenue decides not to follow the statute, and takes the position that super-depreciation is not allowed.

Pennsylvania super-depreciation leaves taxpayers with additional compliance burdens, as well as accounting and return filing choices.

- A taxpayer following the statute and claiming Pennsylvania super-depreciation would depreciate property for Pennsylvania purposes more quickly than most other states that decouple from bonus. While this can create a substantial current-year tax benefit, it significantly complicates compliance.

- Alternatively, a taxpayer choosing not follow Pennsylvania super-depreciation may risk permanently losing out on depreciation deductions. Historically, the Department of Revenue has taken the position that if a taxpayer fails to take depreciation when required by statute, the depreciation is permanently disallowed.

While Pennsylvania’s statutory attempt to decouple from federal bonus might continue to be flawed, the argument remains that, like the initial mathematical formula in 2002 accomplished, Pennsylvania intended to put the taxpayer in the same position it would have been if bonus depreciation did not exist.

- See, e.g., Ariz. Rev. Stat. Ann. §§ 43-1121(4), 43-1122(20).

- See Act 89 of 2002 (Pa. H.B. 1848) (enacted Jul. 29, 2002).

- See Pa. Dept. of Revenue Corptax 168k Example, available at revenue.pa.gov. (property placed in service in 50% bonus years has substantial unrecovered depreciation when fully depreciated for federal purposes).

- It was a mere timing difference because the statute allowed a catch-up deduction in the earlier of the year the property was fully depreciated for federal purposes or disposed of to the extent the bonus depreciation added back had not been fully recovered through subsequent-year Pennsylvania subtractions. See id.; 72 P.S. § 7401(3)1.(s)(1).

- P.L. 115-97 § 13201; Pa. Corp. Tax Bulletin No. 2017-02 (Dec. 22, 2017). See our prior alert on this change at reedsmith.com.

- 72 P.S. § 7401(3)1.(r)(2), (s) (enacted by Act 72 of 2018 (Pa. S.B. 1056) (enacted Jun. 28, 2018)).

- As a result of the legislative fix, for property placed into service from September 28, 2017 through December 31, 2022, taxpayers could do what they did in most other states: simply depreciate property as if federal bonus did not exist.

- Specifically, 80% of the adjusted basis of property placed in service on or after January 1, 2023 and before January 1, 2024. IRC § 168(k)(1), (6).

- The Modified Accelerated Cost Recovery System under IRC § 168.

- Specifically, 20% of the adjusted basis of property placed in service on or after January 1, 2023 and before January 1, 2024. IRC § 168(k)(1), (6).

- 72 P.S. § 7401(3)1.(q).

- Specifically, 100% of the adjusted basis for the property. 72 P.S. § 7401(3)1.(r)(2). This is because the additional deduction is equal to “the depreciation on the qualified property” determined under IRC §§ 167, 168, without regard to IRC § 168(k). Id. That means the MACRS depreciation is computed without regard to the basis adjustment that results from claiming bonus depreciation. IRC § 168(k)(1).

- When federal bonus depreciation becomes zero in 2027, Pennsylvania super depreciation goes away entirely. That’s because Pennsylvania bonus depreciation adjustments are not applicable to property for which no bonus has been claimed. See 72 P.S. § 7401(3)1.(q).

- 72 P.S. § 7401(3)1.(r)(2) (“additional deduction … allowed … until the total [bonus added back in year one] … has been claimed.”).

- A taxpayer depreciating property as if federal bonus did not exist would get a deduction of $33.33 ($100 purchase price x 33.33%, the first-year MACRS rate for three -year property). A taxpayer using Pennsylvania accelerated depreciation gets 120% of that in 2023 ($40 Pennsylvania super-depreciation / $33.33 non-bonus MACRS).

Client Alert 2023-126