Read time: 4 minutes

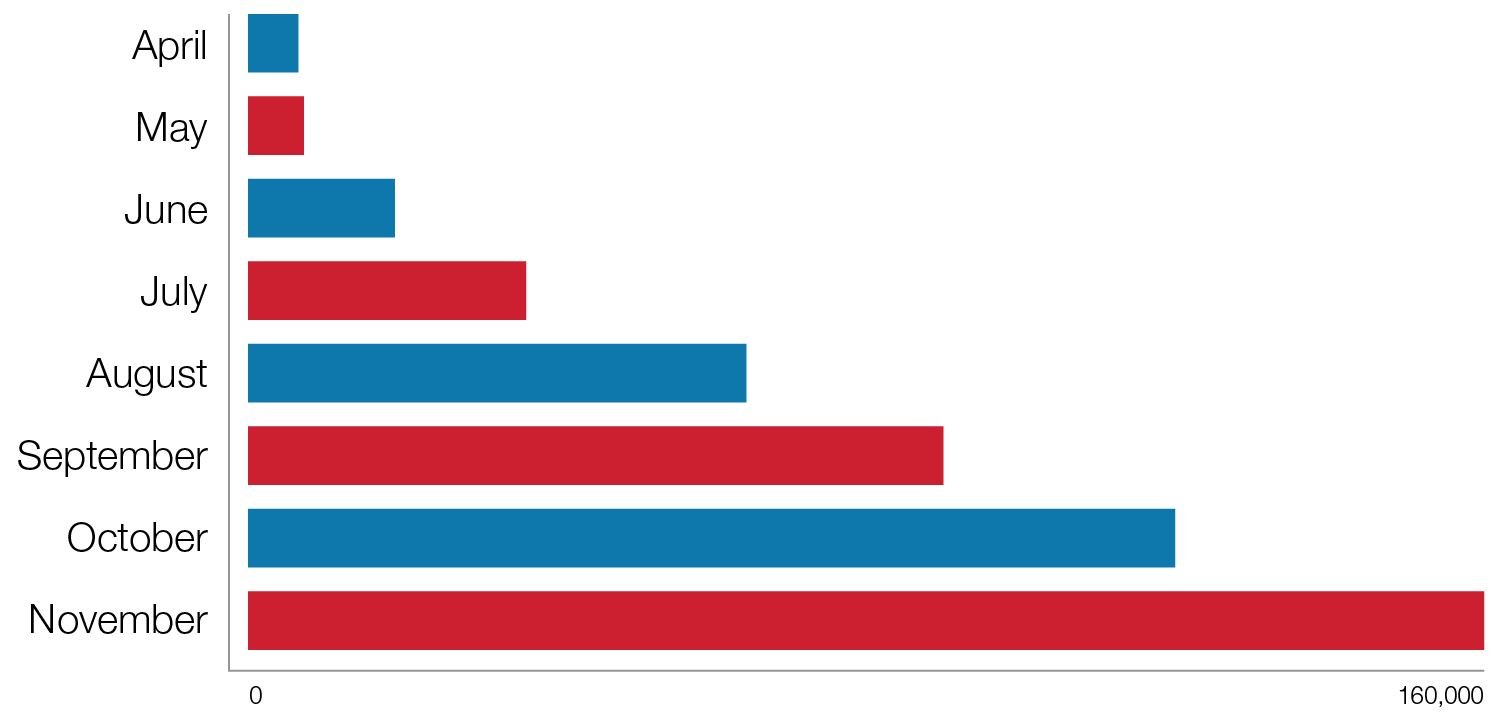

Independent dispute resolution (IDR) ‒ the federally-administered method of resolving surprise billing disputes under the No Surprises Act (NSA) ‒ has exploded since it went live in March 2022, and this trend likely will continue. Out-of-network providers can use IDR to dispute payments for three types of services: emergency services, professional services at participating facilities and air ambulance services. IDR started slowly but quickly snowballed into a highly utilized federal procedure ‒ and a giant headache for payors. At the beginning of May 2022, roughly 700 IDRs had been initiated by providers seeking additional reimbursement. That number rose to above 7,000 by the end of May; and six months later, providers had initiated over 120,000 IDRs.

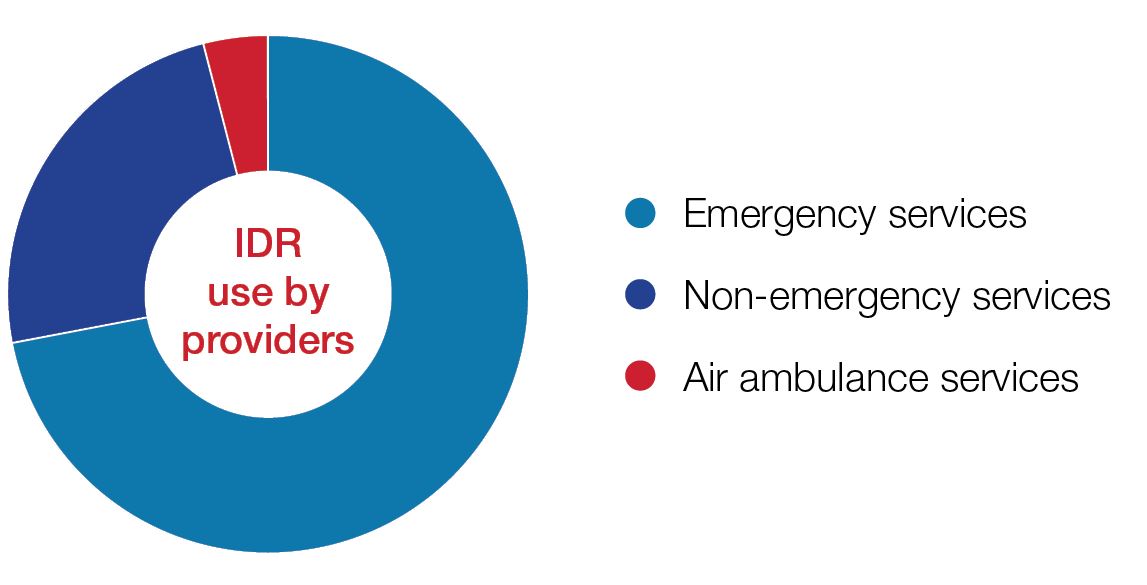

The Centers for Medicare and Medicaid Services (CMS) recently issued high-level data regarding IDR statistics from April 15, 2022 to September 30, 2022, confirming the steep and unexpected rise in IDR use by providers. During this period, 72 percent of disputes involved emergency services, 24 percent involved non-emergency services (primarily radiology, anesthesiology, and pathology services) and air ambulance services made up the remaining 4 percent. Texas providers led in IDR initiations by a large margin, with Florida, Georgia, Tennessee and North Carolina providers rounding out the top five in IDR initiations.

The Reed Smith Managed Care team has additional industry-level insights and expects the exponential growth of IDR to continue in 2023. Based on our representations in this space, and confirmed by CMS’s initial reporting, the current IDR volume is primarily driven by for-profit providers who are also frequent-flyer litigants. We have seen increased volume from these providers as they hone their processes into assembly-line-style IDR initiations. In addition, less dominant providers are building the infrastructure to systematically pursue IDR, which will add to 2023 disputes. Finally, some payors are renegotiating contracts with providers who leveraged surprise billing to negotiate rates far above reasonable market value. If negotiations fail and the providers go out of network, the loss of revenue stream will likely cause these providers to pursue IDR in 2023 as well.

- High utilization of independent dispute resolution is likely to continue into 2023 as providers hone their IDR processes.

- Due to payors’ attempts to renegotiate above-market rates, more providers might go out of network.

- Although there is variation by region and provider types, results to-date have trended near the payor-determined “qualifying payment amount” (QPA).

- Providers could have a higher success rate in the wake of the most recent Texas Medical Association opinion, which vacated regulatory provisions that emphasize QPA in IDR.

- Effective counterarguments and nimble strategy are important, particularly in light of the Texas Medical Association opinion.