On 31 March 2021, the Singapore Exchange (SGX) released a consultation paper seeking public feedback on its proposed listing framework for special purpose acquisition companies (SPACs). The consultation closes on 28 April 2021.

What are SPACs? Why SPACs?

SPACs, also known as ‘blank check companies’, are listed entities with no prior operating history, operating and revenue-generating business, or assets at the time of listing. SPACs raise funds for the sole purpose of acquiring viable businesses or assets, typically implemented via a merger, share exchange or other, similar method of business combination, typically referred to as a ‘de-SPAC’ transaction. If a SPAC is not able to successfully execute a ‘de-SPAC’ within a prescribed period of time, the SPAC is liquidated and the funds raised are returned to public shareholders.

The rise in popularity of SPACs can be attributed to two key reasons:

- Time to market. This is perceived to be one of the greatest advantages of a SPAC listing. Unlike a traditional IPO process that can stretch over months and sometimes years, SPAC listings in certain jurisdictions can be rolled out in a matter of weeks.

- Certainty. This certainty is in terms of both funding and pricing. In a traditional IPO, there is a book-building process where issuer managers or sponsors conduct road shows, etc., to work out whether it is viable to raise the extent of the funds that the issuer is asking for, and also how the issuer is to be priced. There would inevitably be uncertainties associated with fund-raising and pricing given volatile and unpredictable market conditions and sentiment. The SPAC, on the other hand, raises the funds in advance. There is certainty in funding when a SPAC seeks to explore a business combination or ‘de-SPAC’ with a target. The pricing for the ‘de-SPAC’ is then negotiated by the management of the SPAC, who are usually experienced fund managers or investment professionals, with the support of an independent valuation.

Key features of SGX’s proposed listing framework

To qualify for a SPAC listing under the proposed listing framework:

- the minimum market capitalisation is S$300 million (in line with the Mainboard listing requirement);

- the public float requirement is for 500 or more public shareholders holding at least 25 per cent of issued shares (in line with the Mainboard listing requirement); and

- the minimum IPO price is S$10 per share (this is priced at a significantly higher threshold compared to the Mainboard minimum IPO price of S$0.5 per share, in view of market norms in other jurisdictions and also the unique risk profile of a SPAC).

The ‘de-SPAC’ transaction has to be completed within three years, subject to approval of a majority of the SPAC’s independent directors and independent shareholders. The shareholders’ circular for a ‘de-SPAC’ transaction is expected to contain prospectus-level disclosures on key areas, such as in relation to the financial position of the incoming business, the character and integrity of incoming directors and management, as well as its standard of compliance with applicable laws and rules.

How does this compare with other leading jurisdictions?

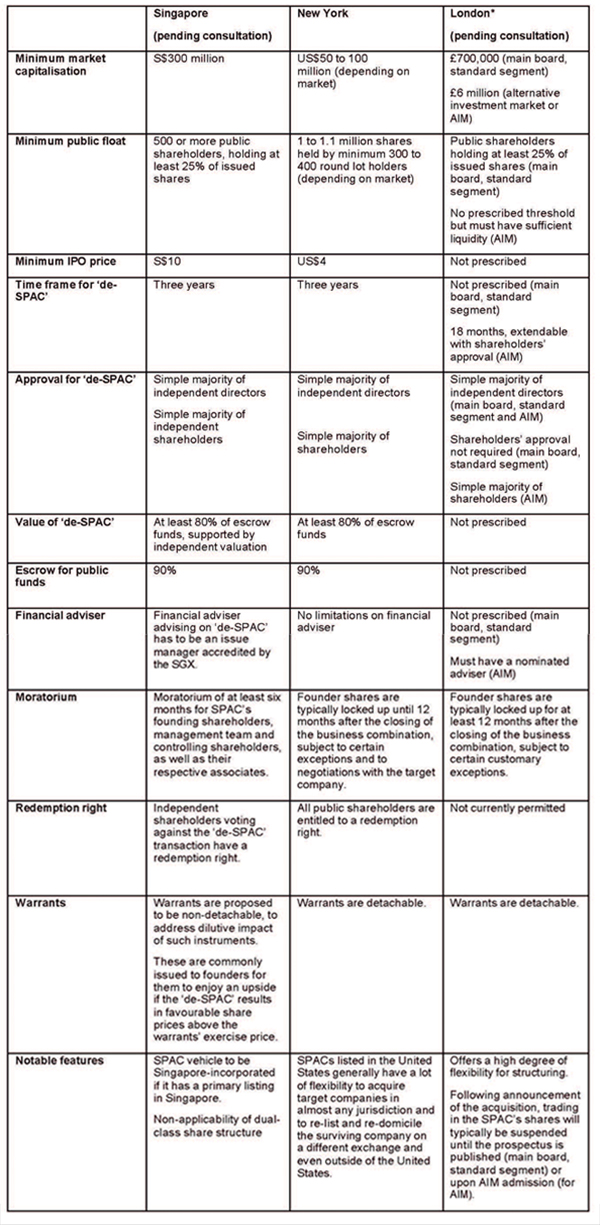

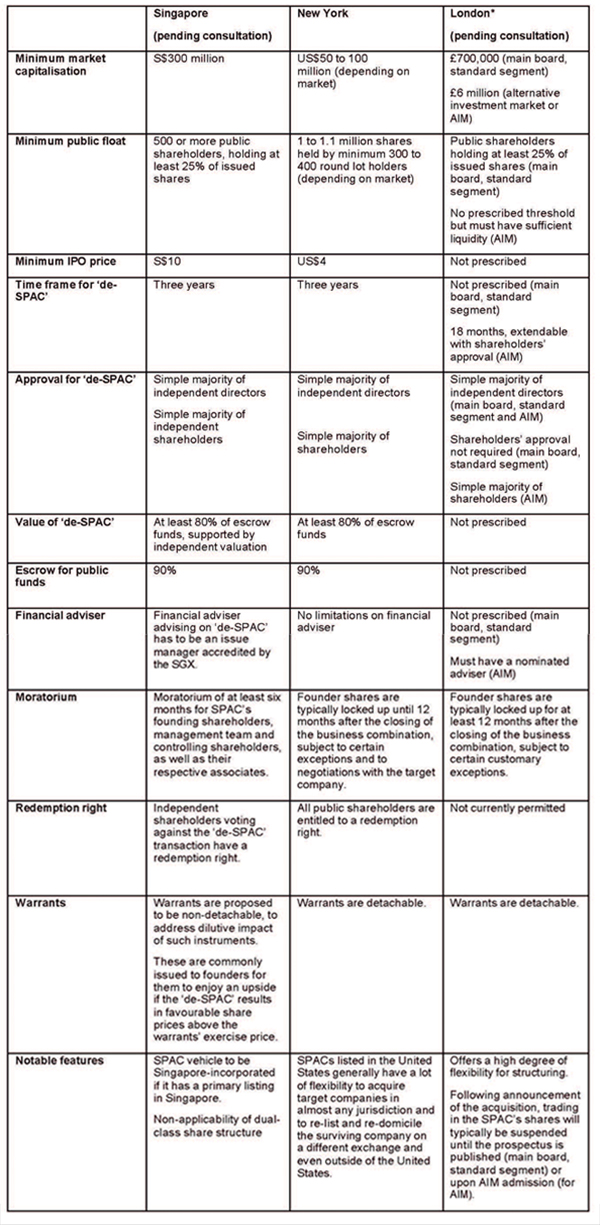

The table below sets out a comparison of Singapore’s SPAC listing framework against that of London and New York.

* SPAC listing rules for London are likely to change. On 31 March 2021, the UK Financial Conduct Authority announced that a consultation will be launched shortly on SPACs, covering structural features, enhanced disclosure, and investor protection, and also aligning some of the rules more closely with the rules in other major jurisdictions.

Hong Kong is studying the feasibility of SPAC listings and the Hong Kong Stock Exchange is expected to launch a public consultation (a precursor to any listing rule change) no later than summer 2021. There is speculation that SPACs will be permitted following some changes to Chapter 21 of the Hong Kong Listing Rules which permit the listing of investment companies. We don't think such listing rule changes are necessarily straight forward given the regulatory clampdown on backdoor listings.

The way ahead – SPAC-tacular or SPAC-culative?

While market cycles can become shorter and more volatile, this should not be a deterrent for businesses with strong fundamentals seeking to list and raise funds. SPACs offer the ability to mitigate market volatility, and also the chance for investors to co-invest with experienced sponsors with a demonstrated track record.

The introduction of a listing framework for SPACs is thus a welcomed and eagerly anticipated development in Singapore.

Reed Smith is a dynamic international law firm dedicated to helping clients move their businesses forward. Our belief is that by delivering smarter and more creative legal services, we will not only enrich our clients’ experiences with us but also support them in achieving their business goals. We are equipped with a global capital markets practice across leading jurisdictions, with recent SPAC transactions comprising:

- Representing SomaLogic in a US$1.23 billion business combination agreement with CM Life Sciences II and concurrent US$375 million PIPE (March 2021)

- Representing Twist Investment Corporation in a US$175 million SPAC IPO (Deutsche Bank acting as underwriter)

- Representing Acamar Partners Acquisition Corp. II in a US$350 million SPAC IPO (BAML, Goldman Sachs and Credit Suisse acting as underwriters)

- Representing Newcourt Acquisition Corp. in a US$200 million SPAC IPO (Barclays acting as underwriter)

- Representing 1Sharpe Acquisition Corp. in a US$225 million SPAC IPO (Barclays acting as underwriter)

- Representing Chardan NexTech Acquisition Corp. in a US$200 million SPAC IPO (Chardan acting as underwriter)

- Representing Chardan NexTech Acquisition 2 Corp. in a US$100 million SPAC IPO (Chardan acting as underwriter)

- Representing Sierra Lake Acquisition Corp. in a US$300 million SPAC IPO (Cantor Fitzgerald acting as underwriter)

- Representing StoneBridge Acquisition Corp. in a US$200 million SPAC IPO (Cantor Fitzgerald acting as underwriter)

- Representing affiliates of Shawn ‘Jay-Z’ Carter in the sale of CMG Partners Inc. and OG Enterprises, Inc. to Subversive Capital Acquisition Corp., a Canadian SPAC

- Represented European Sustainable Growth Acquisition Corp. in a US$125 million SPAC IPO (closed in January 2021)

- Represented ITHAX Acquisition Corp. in a US$175 million SPAC IPO (closed in February 2021)

- Represented Cantor Fitzgerald in a US$240 million SPAC IPO by Healthcare Capital Co. (closed in January 2021)

- Represented Cantor Fitzgerald in a US$200 million SPAC IPO by 7GC & Co. Holdings Inc. (closed in December 2020)

- Represented Cantor Fitzgerald in a US$200 million SPAC IPO by Biotech Acquisition Co. (closed in January 2021)

- Represented B. Riley in a US$300 million SPAC IPO by African Gold Acquisition Corp. (closed in March 2021)

- Represented B. Riley in a US$100 million SPAC IPO by Evo Acquisition Corp. (closed in March 2021)

- Represented Chardan Capital Markets in a US$50 million SPAC IPO by Mountain Crest Acquisition Corp. II (closed in January 2021)

With 3,000 people across 30 offices, including more than 1,700 lawyers, our long-standing relationships and collaborative structure make us the go-to partner for the speedy resolution of complex disputes, transactions, and regulatory matters. Reed Smith in Singapore is in a Formal Law Alliance with Singapore law practice Resource Law LLC. The Reed Smith Resource Law Alliance expands our ability to handle multi-jurisdictional transactions involving both international and Singapore law.

Reed Smith LLP is licensed to operate as a foreign law practice in Singapore under the name and style, Reed Smith Pte Ltd (hereafter collectively, "Reed Smith"). Where advice on Singapore law is required, we will refer the matter to and work with Reed Smith's Formal Law Alliance partner in Singapore, Resource Law LLC, where necessary.

Client Alert 2021-105