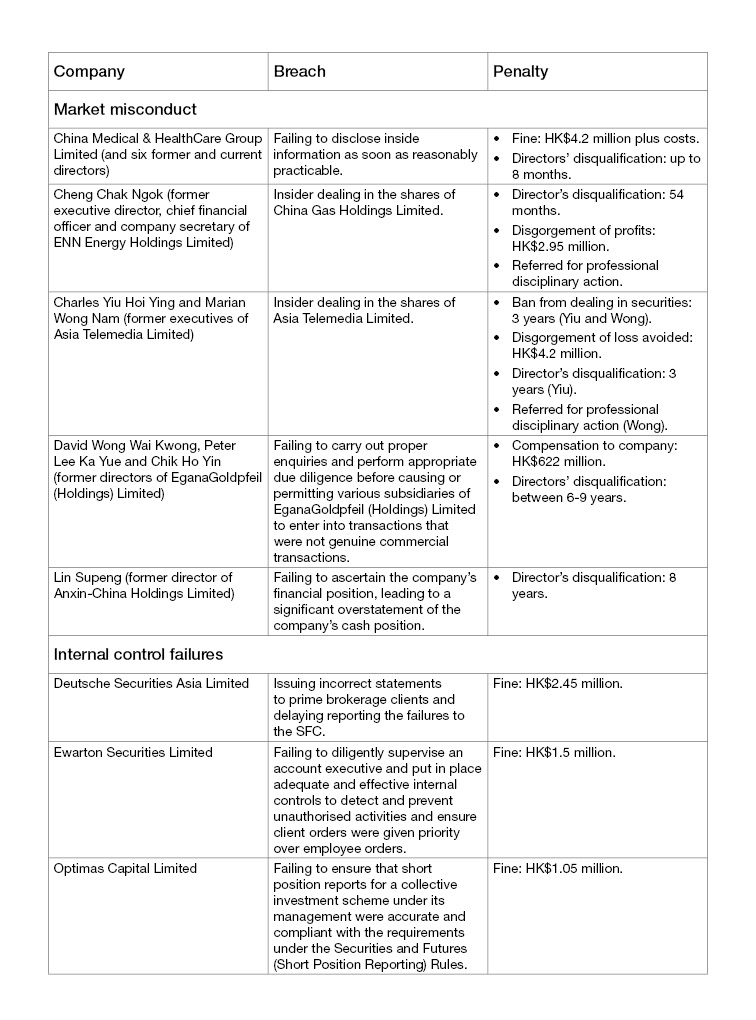

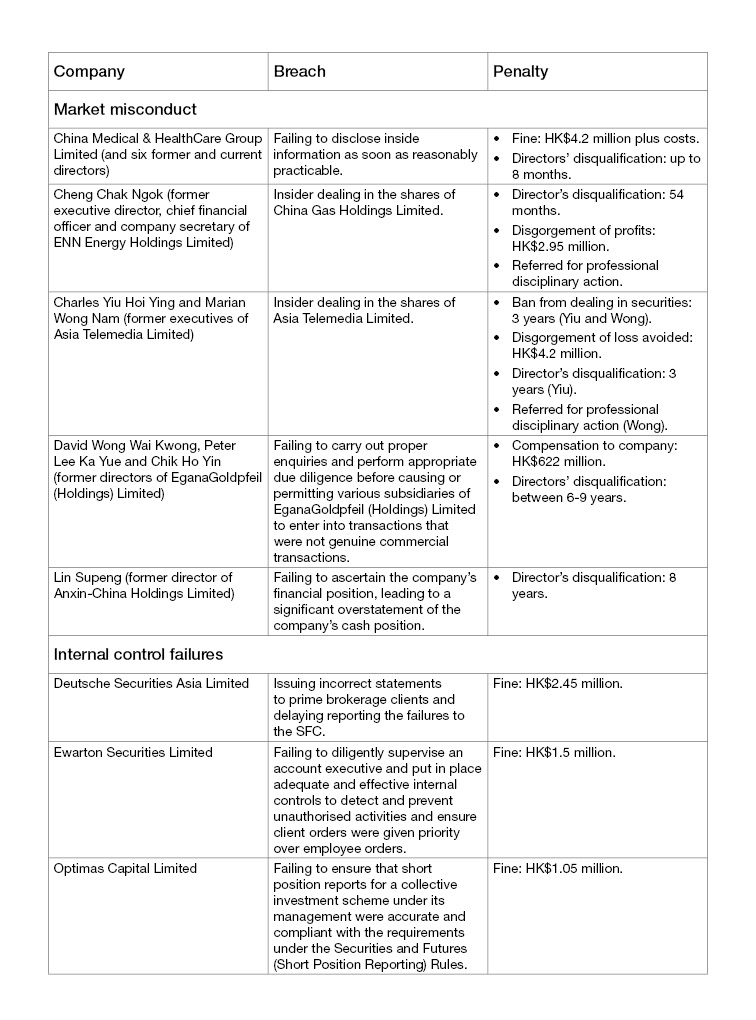

Highlights of the recent enforcement actions

Key trends in relation to the SFC’s recent enforcement activities

The SFC continues to be highly active in its enforcement activities and we have observed upward trends (compared to this time last year) in:

- the number of enquiries raised (substantial increases of between 50-100% in formal inquiries or requests for production of documents and records through section 179 inquiries, section 181 inquiries and section 182 directions);

- the number of investigations started (from 33 to 62 – an increase of 87.9%);

- the number of criminal charges laid (from 3 to 18 – an increase of 500%);

- the number of Notices of Proposed Disciplinary Action issued (from 4 to 10 – an increase of 150%); and

- the number of search warrants executed (from 2 to 20 – an increase of 900%).

The SFC also conducted 71 on-site inspections of licensed corporations to review their compliance with the applicable regulatory requirements. Among the 245 breaches identified during the on-site inspections, about 70% of the breaches are related to a breach of the Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission; non-compliance with anti-money laundering guidelines; or internal control weaknesses.

Highlights of the regulatory enhancements

The SFC, in conjunction with the Stock Exchange of Hong Kong Limited (SEHK), have implemented measures to enhance the regulatory regime in various areas, especially in relation to the competency framework and listing regulation, as reflected in the following highlights:

- Competency framework – the SFC published revised Guidelines on Competence, Guidelines on Continuous Professional Training, and Fit and Proper Guidelines to update the competency framework for intermediaries and individual practitioners. The revised guidelines will take effect on 1 January 2022.

- Main Board profit requirement – the SFC collaborated with SEHK on the consultation for increasing the minimum profit requirement for new listings on the Main Board. The new profit thresholds will take effect on 1 January 2022.

- Misconduct related to new listings – the SFC and SEHK published a joint statement on their efforts to combat misconduct and improper behaviour related to new listings through heightened scrutiny of listing applications and identification of red flags which indicate a lack of genuine investor interest.

- SEHK’s disciplinary powers and sanctions – following the SFC’s recommendation, SEHK implemented new rules on 3 July 2021 to enhance its disciplinary powers and sanctions. This has strengthened SEHK’s ability to hold directors and other individuals accountable for misconduct and non-compliance with regulatory requirements.

Collaboration with other enforcement agencies and authorities

The SFC has collaborated closely with other enforcement agencies, including conducting a joint operation with the Commercial Crime Bureau of the Hong Kong Police Force in April 2021 against a syndicate suspected of operating ramp-and-dump market manipulation schemes and committing fraud. They have conducted dawn raids on office premises and personal residences, and facilitated arrests of senior executives suspected of conspiracy to defraud and embezzlement of over HK$19 million.

The SFC has also continued its cross-border enforcement cooperation with the China Securities Regulatory Commission and in June 2021 held a high-level meeting on further enforcement cooperation. The discussions centred on:

- cooperation arrangements for high-priority cases;

- adjustments to the mutual enforcement cooperation mechanism; and

- information sharing, staff training and the representative action mechanism to protect the collective interests of investors in securities disputes as set out under China’s new Securities Law.

Conclusion

The above highlights of the recent enforcement actions, statistics and regulatory enhancements reported in the Q2 2021 Quarterly Report show that the SFC continues to adopt a front-loaded regulatory approach with a focus on “high-impact” cases. The SFC also remains committed to taking active steps to enhance the regulatory framework in response to the evolving financial landscape. Listed companies, financial institutions, and licensed persons and corporations should at all times remain vigilant and ensure that effective measures have been put in place to:

- closely monitor their compliance with the applicable regulatory obligations;

- bolster internal controls and systems; and

- maintain good record-keeping practices and provide ongoing staff training in compliance matters.

This will ensure that they are well prepared, and can readily and credibly respond, in the event of any regulatory scrutiny.

Client Alert 2021-222