SB 113

In 2020, the California Legislature suspended the use of NOLs and capped business tax credit usage at $5 million for tax years 2020, 2021, and 2022 to combat projected budget deficits resulting from the COVID-19 pandemic.2 Now, two years later, the California Legislature enacted SB 113, which includes an early termination to the NOL suspension and removes the $5 million limit on the usage of business tax credits for the 2022 tax year.3 Taxpayers may now deduct NOLs and utilize business tax credits without the cap on their 2022 tax return.

In addition to the restored NOLs and the removal of the credit cap, SB 113 made several updates to the PTE tax credit. When Assembly Bill 150 (AB 150) was signed into law on July 16, 2021, it established the PTE tax credit scheme, which was intended to function as workaround to the federal income tax state and local tax (SALT) deduction cap enacted as part of the 2017 Tax Cuts and Jobs Act (“TCJA”). AB 150 limited the benefit of SALT cap workaround to certain situations. SB 113 expands the definition of qualified taxpayers, qualified income, and expands the type of taxes that taxpayers may offset with the PTE tax credit. First, SB 113 allows a taxpayer to utilize the PTE tax credit to reduce it tax liability below its tentative minimum tax.4 Further, SB 113 updated the definition of "qualified entity" to include a pass-through entity that has a partnership as an owner and updated the definition of “qualified taxpayer” to include taxpayers that are single-members of a limited liability company that is disregarded for federal tax purposes and meets specified criteria.5 Additionally, guaranteed payments, as defined by IRC Section 707(c), are now included in the definition of “qualified net income,” and thus qualify for the credit. All changes noted above will apply retroactively to tax year 2021.

Finally, effective for tax years beginning on or after January 1, 2022, the PTE tax credit is required to be applied against the net tax after credits for taxes paid to other states.6 For tax year 2021, the PTE tax credit is applied against the net tax before credits for taxes paid to other states.7

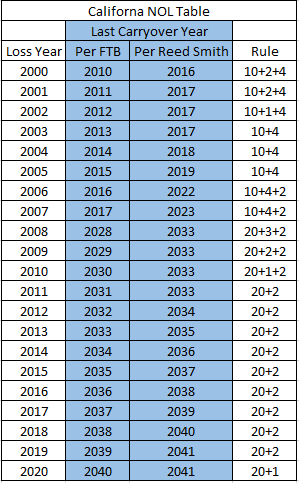

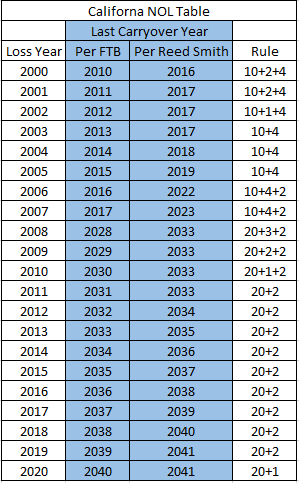

Taxpayers may be able to extend their NOL carryover period by up to *six* years

In a recent alert, we discussed how some taxpayers may be able to extend the carryover period for their NOLs by up to seven years. Given the early termination of California’s NOL suspension, taxpayers will likely have a one year shorter maximum extension period, meaning there is now a maximum additional carryover of six years. Thus, the carryover period of California NOLs carried forward into the suspension years should be extended as follows:

Technical Advice Memorandum (TAM) 2022-01

On February 14, 2022 FTB released TAM 2022-01, which brought the FTB’s position on how certain internet-related activities effect the application of P.L. 86-272 in line with the position taken by the Multistate Tax Commission. In the TAM, the FTB provides 12 hypothetical scenarios involving activities undertaken by companies domiciled outside of California and conclude whether those activities are protected under P.L 86-272.

The conclusions are not taxpayer friendly, as the FTB seeks to weaken the protections of federal law. For example, in the TAM, the FTB concludes that businesses collecting internet “cookies” from California customers’ search information would exceed the protections of P.L. 86-272. In another hypothetical, the FTB concludes that providing access to job applications to Californians over the internet, in which applicants can upload their resumes and cover letters, disqualifies businesses from P.L 86-272 protections.

Conclusion

SB 113 is a rarity in California – taxpayer friendly legislation that limits the application of prior taxpayer-unfriendly legislation. The changes in SB 113 provide some welcome relief to California taxpayers. Unfortunately, the position taken by the FTB in TAM 2022-01 is decidedly taxpayer-unfriendly, and would have the effect of weakening the protections provided by a federal law through an administrative notice.

- S.B. 113, 2021-2022 Reg. Sess. (Cal. 2022) (Passed unanimously in Assembly and Senate February 7, 2022, Approved by Governor February 9, 2022).

- A.B. 85, 2019-2020 (Approved by Governor June 29, 2020); CALIFORNIA BUDGET SUMMARY: MAY REVISION, INTRODUCTION, May 14, 2020.

- Cal Rev. & Tax Code § 23036.3 & 24416.23 (changing the language from "beginning on or after January 1, 2020, and before January 1, 2023" to "beginning on or after January 1, 2020, and before January 1, 2022.").

- SB 113 amended 17039(c)(1) adding paragraph (AD) noting the credit can be used to reduce liability below the tentative minimum tax Cal. Rev. & Tax Code § 17039(c)(1)(AD) (“For taxable years beginning on or after January 1, 2021, the credit allowed by Section 17052.10 (relating to the elective tax under the Small Business Relief Act).

- A disregarded LLC can be a “qualified taxpayer” if it “[i]s owned by a taxpayer, as defined in Section 17004, excluding partnerships, that consented to have the sum of their guaranteed payments and pro rata share or distributive share of income, as determined under this part and Part 11 (commencing with Section 23001), subject to tax under this part included in the qualified net income, as defined in Section 19900, of the electing qualified entity” and “[i]s a partner, shareholder, or member of an electing qualified entity.” Cal. Rev. & Tax Code § 17052.10(b)(C) (i)-(ii).

- Cal. Rev & Tax Code 17309(a)(5)(B).

- Cal. Rev & Tax Code 17309(a)(5)(A), (B).

Client Alert 2022-051