The COVID-19 crisis impacted the aviation sector in strikingly different ways for passenger and air cargo sectors. The impending insolvency situation, ongoing issues with carrier flexibility, and greater reliance on air freight stand out as primary drivers of the increase of claims. These factors have shaped the number and nature of cargo claims over the past two or three years. As we near the end of 2021, we predict the focus will turn to managing a post-COVID transition and repositioning businesses to address the mounting revival of air passenger travel.

Impact of COVID-19 on the aviation industry

According to the International Air Transport Association (IATA), 2020 has been confirmed as the worst year on record for the airline industry. In a publication titled “IATA World Air Transport Statistics” (WATS), performance figures for 2020 reveal the damaging impact of the COVID-19 crisis on global air transport.

In summary, total industry passenger revenues fell by 69 percent and net losses totaled $126.4 billion. Most damning of all, the decline in air passenger transportation in 2020 was the largest single drop recorded since global revenue passenger kilometers were first tracked in around 1950. Flowing from the fact that passenger aircraft are responsible for transporting almost half of all air cargo shipments, the air freight market worldwide has equally been affected by COVID-19.

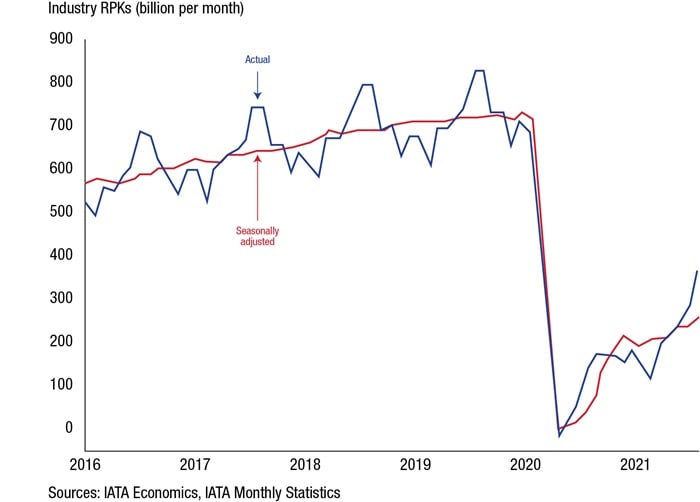

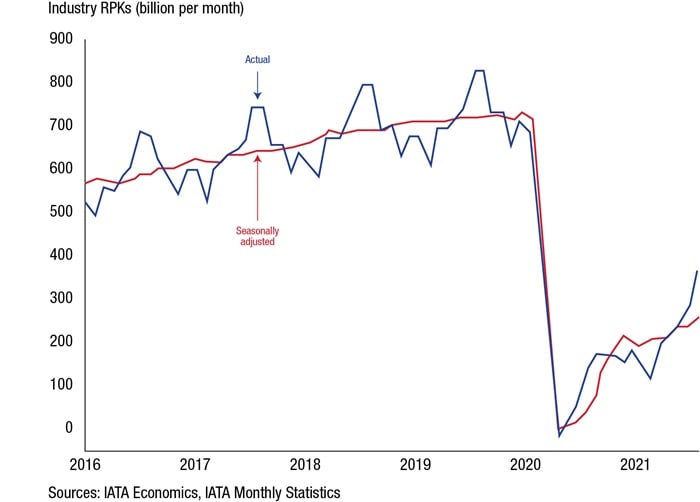

Chart 1: CTK levels, actual and seasonally adjusted

Chart 1 (above), taken from the IATA Air Cargo Market Analysis July 2021, highlights the substantial fall of industry-wide cargo ton-kilometers (CTKs) in the first quarter of 2020. Remarkably, the seasonally adjusted metric in red (which evens out periodic swings) has rebounded strongly from May 2020, when strict lockdowns were lifted, with CTKs around 5 percent higher than the pre-crisis peak in August 2018.

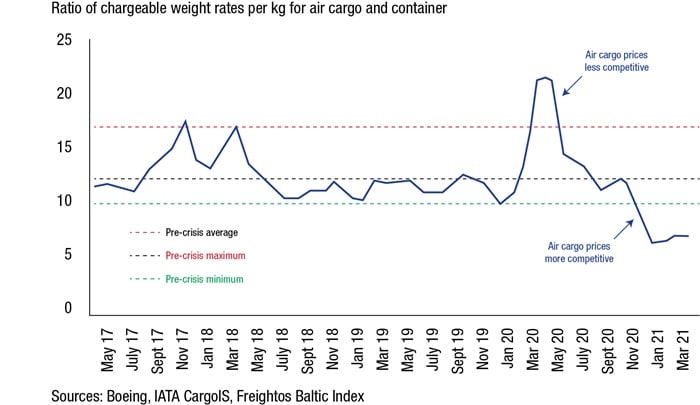

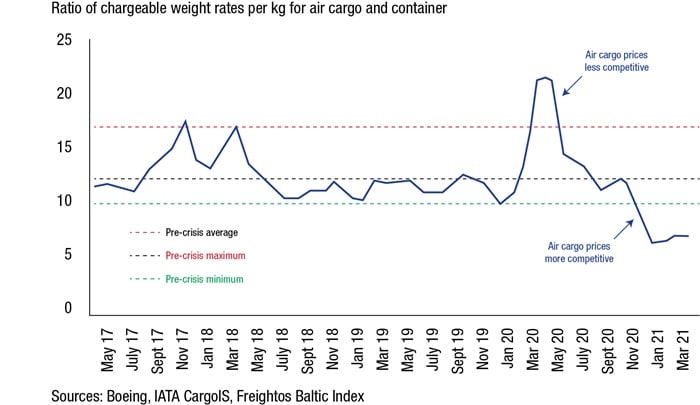

In the passenger market, however, the situation is not as promising. Chart 2 (below) highlights a rebound of only 50 percent (approximately) compared to pre-COVID-19 levels. Closely tied to demand, the price for air cargo has equally been shaped by the crisis; see, for example, Chart 3 below. Pre-COVID-19, air cargo was around 12 times more expensive than ocean freight. While prices significantly rose in April 2020 during the early stages of the pandemic when supply declined, they have since fallen to competitive rates when compared with container shipping.

Chart 2: Global air passenger volumes (RPKs)

Chart 3: Prices of air cargo and container shipping per kg of chargeable weight

Cargo claims for air freight

Freight claims in the aviation industry typically arise due to one of four possible scenarios: (1) physical damage to shipments whether noticed before or after delivery; (2) shipments delivered short; (3) refusal in part or in whole (wrong freight, product damage, or late shipment); and (4) shipments lost by the carrier.

Importantly, the liability for any possible damage or loss to a shipment depends on the contractual position between the shipper, carrier, and receiver. By way of example, the carrier (that is, the airline) will likely have an insurance policy that provides cover under Institute Cargo Clauses (Air), determining what risks of loss of or damage to cargo are covered. More significantly, the Air Waybill (AWB), an air cargo document that constitutes the contract of carriage between shipper and carrier (airline), will also include provisions with respect to risk and liability.

At the start of 2019, the Electronic Air Waybill Resolution 672 (MeA) (e-AWB) became the default contract of carriage for all air cargo shipments on enabled trade lanes. The e-AWB removed the requirement for a paper AWB and sets out the respective liabilities between the parties at article 9.

Impact of the COVID-19 pandemic on cargo claims

Impending insolvency

With COVID-19 profoundly affecting airline companies, largely due to travel restrictions, numerous bankruptcies have ensued with some airlines ceasing operations altogether. The impending threat of insolvency appears to have triggered a mindset shift in the aviation sector. Market participants are placing greater focus on every revenue stream available and seeking to increase their reliance on claims, most notably freight forwarders, importers, and exporters. Motivated financially, such parties are no longer willing to neglect claims in a scenario where “every penny counts,” doing all they can to keep their businesses afloat.

Falling outside the scope of this article in a strict sense, it is important to note that beyond cargo claims there has been an increase in claims of a different nature. These have included abandoned cargo claims, repairs and maintenance claims, and claims against additional and unexpected fees. It is clear that post-COVID-19, if such a term can be applied to the situation we find ourselves in today, akin to the global supply chain, the aviation sector has emerged more mindful of finances and pursuing claims in a more productive and frequent fashion.

Ongoing issues – carrier flexibility

Significant difficulties have also arisen for freight forwarders and consolidators on account of carrier flexibility. Cirum, a global leader in aviation and travel data and analytics, reveals that dynamic carrier schedules, which were often set months in advance and never changed, are changing regularly. Looking at passenger flights alone, March 2021 saw 24% of all flights had to be rescheduled.

Freight forwarders and consolidators who are unable to track changes in the schedule, equipment, and route are at risk of disruption and therefore at risk of an increase in cargo-related claims. Any liability arising from the delay or damage to cargo (from the delay) will quickly negate any profitability of operations. Nevertheless, Cirum emphasizes that sector participants may be able to avoid risk and disruption altogether by tracking such changes, adapting quickly, and finding efficiencies.

Greater reliance on air freight

Finally, the increase in cargo claims may simply be due to a greater reliance on air freight. When considering why shippers are looking to air freight, there are two interesting conclusions that can be drawn. One reason might be that due to the congestion of ports, which has reached all-time highs, in comparison to airports, where there has been a significant fall in passenger demand, air cargo does not experience the same delays. For many years air freight has been a preferred method of transportation for shippers of perishables. However, alternative shippers are likely to utilize air transport in the current market, not just due to its speed but also its increased reliability.

Another large issue is the container shortage hurting the global supply chain. Subsequently, air cargo does not use containers, making it more available and desirable to shippers. This is evidenced further by the surge in passenger-airliner freight (preighter) operations that are keeping passenger aircraft in operation and meeting the increased air freight demand.

Regardless of the exact reason for the shift from sea to air, COVID-19 has significantly affected the entire global supply chain. The aviation sector, however, has been instrumental not only in the transportation of medicines and medical equipment but in keeping global supply chains functioning by transporting food, basic necessities, and other essential commodities. It will be interesting to see how the sector shifts as the disruption is resolved. However, with no end in sight, this is unlikely to be any time soon.

Conclusion

Despite continued supply chain disruption (most notably at sea), the sector has bounced back from the pandemic-related crisis in a short space of time. Leaving a trail of disruption and an increase in cargo-related liability claims, the crisis will continue to play out, with such claims likely to continue for some time. It is difficult to point to a single factor responsible for the increase, however, (1) the impending insolvency situation, (2) ongoing issues with carrier flexibility, or (3) a greater reliance on air freight, or any combination of these factors, have largely shaped the number and nature of cargo claims over the past two or three years. Despite the increase, the aviation sector has been essential for the supply of essential goods, and participants have been flexible, imaginative, and considered in their approach. As we near the end of 2021, we predict that the focus will now turn to managing a post-COVID transition and the complications of the ever-increasing revival of air passenger travel.

About the authors

Jody Wood is a disputes lawyer, specialising in commercial litigation and international arbitration. Jody worked in Singapore between 2008 and 2017, and was a founding member of Reed Smith’s Singapore office which opened in 2012. Jody’s practice encompasses disputes in the shipping, trade and aviation sectors and his clients include maritime owners/charterers/managers, aviation lessors/lessees, insurers, banks, funds and commodity traders. A significant aspect of Jody’s practice concerns enforcement of security on behalf of lenders, including multi-jurisdictional strategies for arrest and possession of aircraft/vessels, and enforcement action against other assets.

Matthew Knowles is a trainee solicitor in the Transportation Industry Group at Reed Smith’s London office. With a focus on contentious matters, Matthew has assisted a number of multinational manufacturers, investment banks, financial institutions, logistics providers, P&I Clubs, ship owners and charterers.