Aside from the measures adopted by tax offices, taxpayers and, in particular, multinational corporations should also take a look at the tools available to tackle the tax issues faced by distressed businesses.

Our insights can help you navigate the tax implications of COVID-19 and show you where we could assist you during this unstable time:

- Circular and decree of the German Federal Ministry of Finance and the Supreme Tax Authorities of the German Federal States

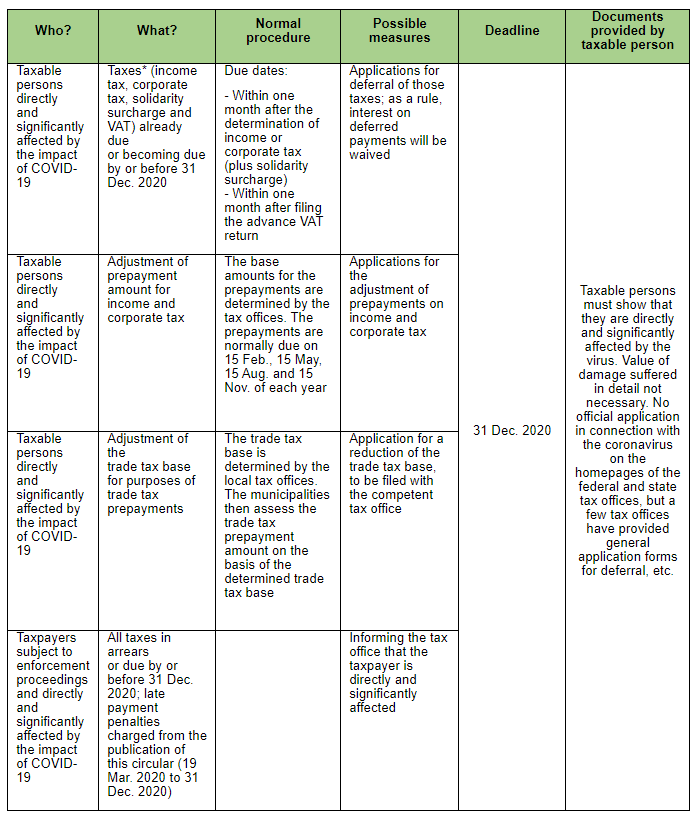

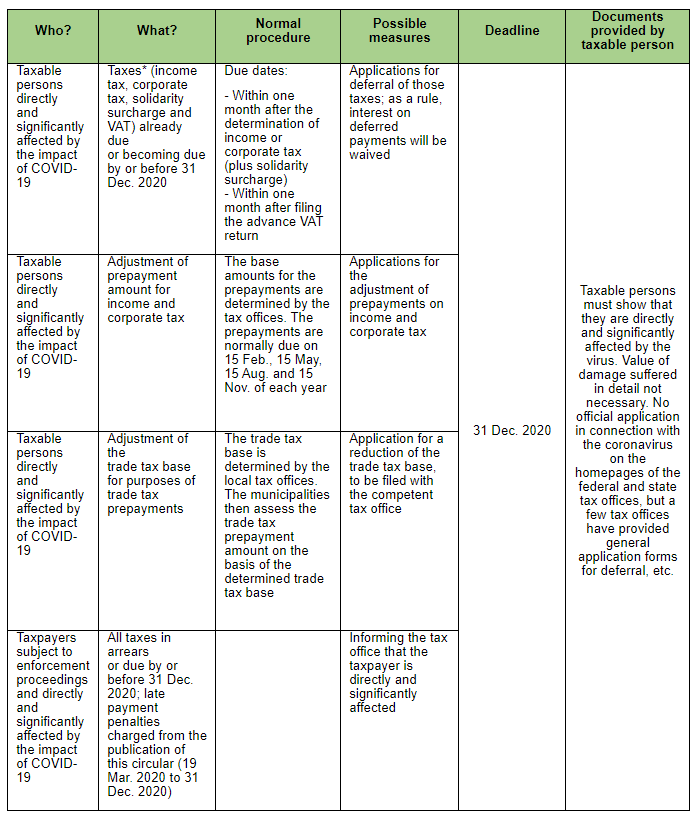

On 19 March 2020 the Federal Ministry of Finance and the Supreme Tax Authorities of the Federal States published, respectively, a circular and a decree introducing tax measures to combat the effects of COVID-19 on the economy.

The following is an overview of the measures which can be taken:

*Please note that tax claims against the taxpayer may not be deferred if a third party has to pay the tax for the account of the taxpayer, in particular in cases where the tax is to be withheld and remitted (e.g. wage taxes and dividend/royalty withholding taxes)

- Economic stabilisation funds (Wirtschaftsstabilisierungsfonds)

The German legislators approved a multi-billion euro rescue fund for distressed large companies. An "economic stabilisation fund" will be used to grant loans and guarantees to companies which, in the last two financial years before 1 January 2020, have met at least two of the following thresholds:

- A balance sheet total of EUR 43 million

- Annual turnover of EUR 50 million

- 50 employees (average per year)

Qualifying companies can file an application for financial support with the German Federal Ministry for Economic Affairs and Energy.

- Debt waiver and subordination of claims

In order to help individual tax payers, liabilities resulting from trading or lending could be released by the creditor. However, a straight waiver of claims by third parties would invariably result in taxable income unless it is part of a qualifying rescue operation which benefits from a specific tax treatment. Also a waiver of a shareholder loan to a distressed subsidiary could result in taxable income. Although the contribution of assets (including the waiver of a claim) in general is a tax-neutral activity under German tax laws, it will result in a taxable gain to the extent that the value of the receivable (i.e., the difference between its nominal value and its fair market value) is impaired. Also, contributions by foreign shareholders may constitute taxable income if the shareholders claim a deduction from their taxable income.

However, there are actions which can be taken to help a distressed subsidiary without incurring material, detrimental tax consequences. For example, the deferral of a payable (including the conversion of a trade receivable into a loan) would not cause tax issues other than a requirement to discount non-interest bearing receivables with a remaining term of more than 12 months. Also, the subordination of a claim would not cause concerns provided that the repayment is not made contingent on future profits or income (otherwise the subordination would result in a fully taxable accounting gains because the liability will have be booked out in the tax accounts).

- Limitation of deduction of losses

Losses incurred by businesses during the COVID-19 crisis may be carried forward for an indefinite period of time and in an unlimited amount under the general corporate income tax regime in Germany. A loss carry-back of up to €1 million is also permissible.

However, a loss carry-forward can only be offset within the limitations of Germany’s minimum taxation rule. Any corporate tax and trade tax losses that are carried forward may be fully utilised for offsetting against (the first) €1 million of net income in a given year. Any remaining losses carried forward may only be offset against up to 60 per cent of any net income exceeding this limit of €1 million. Any remaining losses have to be carried forward to the next fiscal year.

Utmost care needs to be taken with the corporate reorganisation of a German group recording a tax-loss carry-forward. Under the current regime, tax losses will be forfeited if 50 per cent or more of the shares in the company recording the tax losses are transferred (which even can apply in a group of companies). Limited exemptions are available from the general loss forfeiture rule when there are built-in capital gains (which might not be the case with a distressed business) and where business activities following the reorganisation are similar in scope.

The Federation of German Industries (Bundesverband der Deutschen Industrie, BDI) has already requested the suspension of the minimum taxation regime and an increase in the limit on loss carry-back during the current crisis in order to relieve businesses of the burden of tax payments at this time.

- Deduction of interest expenses

The deduction of interest expenses might likewise be impaired in the current crisis. Under the German interest barrier regime interest expenses are fully deductible up to the total amount of interest income in the same fiscal year. Any net interest expenses in excess of this limit are only deductible up to an amount to 30 per cent of the taxable EBITDA (annual pre-loss carry-forward profits for tax purposes, before interest and tax depreciation) of a German taxpayer’s business. Obviously, in a distressed situation the EBITDA of a business will go down significantly, resulting in a reduced threshold for interest deduction.

There are, however, three exemptions that allow the deduction of interest on debts:

- De minimis exemption: net interest expense of less than €3 million annually

- Stand-alone exemption: the corporate taxpayer does not belong to any potential group of companies (Konzern) for accounting purposes

- Group exemption under an ‘escape clause’: the equity ratio of the German corporate taxpayer at the end of the preceding financial year does not fall short of the overall ratio for the whole group of companies by more than 2 per cent

The second and third exemption are limited to businesses where the interest payable to related parties is not more than 10 per cent of total interest expenses.

Interest expenses that are not tax deductible in a given period can be carried forward without restriction and potentially deducted in subsequent years, subject to the interest barrier rules. As a result, businesses which show a loss in their GAAP accounts may still see their income subject to taxation due to the application of the interest barrier regime.

- Conclusion

During the COVID-19 crisis certain features of German tax law may even aggravate the tax position of distressed businesses. Until further measures are taken by the tax authorities or the legislature, careful planning is required before undertaking restructuring or rescue operations, in order to avoid any negative tax consequences.

Our Reed Smith Coronavirus team includes multidisciplinary lawyers from Asia, EME and the United States who stand ready to advise you on the issues above or others you may face related to COVID-19.

For more information on the legal and business implications of COVID-19, visit the Reed Smith Coronavirus (COVID-19) Resource Center or contact us at COVID-19@reedsmith.com.

Client Alert 2020-197