Read time: 5 minutes (1007 words)

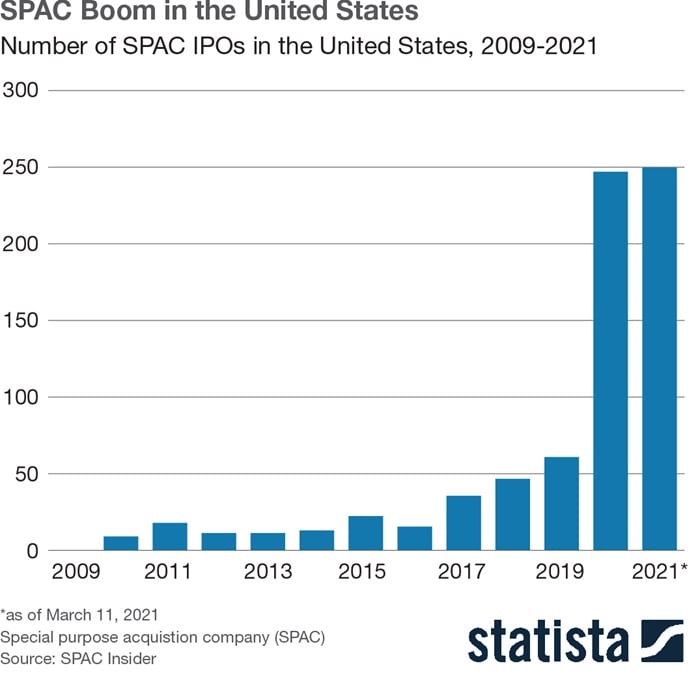

Special purpose acquisition companies, or SPACs, have become a widely accepted vehicle by which companies can go public rather than through a traditional initial public offering (IPO). With nearly 300 SPAC IPO quarterly filings in Q1 2021, the SPAC market now towers over traditional IPOs by a four-to-one ratio. Shaquille O’Neal has his own SPAC (think about that – a ShaqSPAC!). In short, the market is undeniably hot. But SPACs are not new.

SPACs begin as publicly-listed blank-check companies whose purpose is to identify and purchase a private company. SPACs have approximately 24 months to identify and acquire a target company. Following the acquisition, the target company will be publicly listed.

Trend within a trend

One of the recent trends in the SPAC market has been for SPACs to acquire multiple targets simultaneously. Historically, SPACs would avoid doing so because of the challenges involved – and the harsh consequences if the deal failed. In the current market, SPACs are trying to present a target company that is of sufficient scale to attract significant PIPE capital and retain the funds in the SPAC’s trust account. Sometimes a particular target is too small, or greater value can be added by rolling multiple targets into the SPAC. Hence the new trend.

With this new trend, one must consider specific challenges, including timing of the closings, conditions to closing, consideration, valuation, exclusivity, and reps and warranties.

Another surprising trend is deals with related-party transactions. Specifically, how does a SPAC navigate a potential acquisition of a company affiliated with the SPAC’s sponsor or management? Some vital issues to consider include pre-IPO discussions between the SPAC and the target, the fairness opinion, and involvement of the conflicted individuals or entities in the process on both sides of the deal.

With that said, the unique advantages of SPAC transactions do not negate the need for proper due diligence. While the importance of due diligence cannot be understated for any type of deal, the risk that is associated with inadequate or less-than-thorough due diligence is especially great for biotechnology companies because the companies’ products can directly affect their end-customers’ (patients’) health, and because they are heavily regulated by multiple government agencies. The high-risk, high-reward nature of this business means that risks can present themselves at any moment, and proper due diligence must be performed to identify any such risk or signs of such risk.

When engaging in a SPAC acquisition, it is typical to perform diligence on several areas that can pose significant risks to investors. These include the below.

Promotional practices

Companies’ promotional practices can have serious implications on whether a product can obtain marketing authorizations from the U.S. Food and Drug Administration (FDA), and on whether the product may become subject to post-marketing enforcement actions from FDA. Companies that fail on compliance are more likely to find themselves liable for marketing unapproved products, off-label promotion, or misrepresentation of the product’s safety and effectiveness.

In certain cases, unlawful promotional practices can trigger fraud and abuse cases from federal program administrators, and other lawsuits from private litigants. These can pose great risks to the company and the SPAC entity even after the transaction closes. While not all noncompliance will result in the deal being scrapped, certain unlawful promotional practices, depending on the potential risk posed by such practices, could be major red flags that sink a deal.

Compliance with clinical trial regulations

For biotechnology companies, ensuring compliance with FDA regulatory requirements pertaining to clinical trials, in particular with good clinical practice, informed consent protections, proper management of financial conflicts of interest, and adherence to institutional review board (IRB) requirements, among others, is critical. Noncompliance may result in FDA refusing to review results of the noncompliant clinical trial or lead to enforcement actions by FDA and state agencies. In addition, litigation and reputational risks are associated with study subjects whose rights are not adequately protected.

- The growth of SPAC IPOs in health care continues into 2021

- SPACs acquire multiple targets simultaneously – and enter into transactions with related entities, introducing new risks

- Due diligence plays an increasingly critical role in helping SPACs avoid pitfalls